The Dynamic Dubai Financial Market

Dynamic Dubai Financial Market. In addition to its iconic skyscrapers and opulent lifestyle, Dubai, the glittering metropolis in the United Arab Emirates, is well-known for its growing financial sector. The Dubai Financial Market (DFM) is evidence of the emirate’s dedication to diversifying its economy and opening doors for foreign investment. In this essay, let us explore the distinctive features of the DFM, its development trajectory, as well as the potential it offers to both domestic and international investors.

A Global Financial Hub in the Middle East

Dubai has established itself as a major financial hub in the Middle East thanks to its advantageous location halfway between the East and the West and its welcoming business environment. In this ecosystem, the DFM is crucial because it offers a platform for businesses to list their shares, investors for trading securities, and a variety of financial services to grow.

Diverse and Dynamic Market

The DFM is home to a wide range of listed businesses from several industries, including banking, telecommunications, real estate and retail. Investors can build well-rounded portfolios thanks to the variety this diversity offers them across a wide range of industries.

Regulatory Framework and Investor Protection

A strong regulatory structure that guarantees openness, equity, and investor protection underlies the operation of the DFM. The Securities and Commodities Authority (SCA) regulates the market and enforces strict rules to preserve its integrity and protect the interests of investors. Participants in the market are given confidence by this dedication to regulation, which also draws both institutional and private investors.

Digital Transformation and Technological Advancements

The DFM is another example of how Dubai has consistently been at the forefront of technical advancement. With the implementation of cutting-edge online investor services, trading platforms, and mobile applications, the industry has embraced digital change. By improving accessibility, ease, and efficiency, these technology developments make it simpler for investors to engage in the market.

Islamic Finance and Sukuk Market

Dubai has become a major global centre for Islamic banking thanks to its long Islamic history. In this area, the DFM is essential since it offers a platform for Sharia-compliant products for investment. Particularly, the Sukuk market has expanded significantly, drawing both domestic and foreign investors looking for sustainable and ethical investment options.

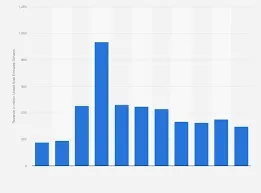

Strong Growth and Performance, Dynamic Dubai Financial Market

Over the years, the DFM has demonstrated impressive growth, reflecting Dubai’s developing economy. The liquidity of the markets has improved, trade volume has risen, and market capitalisation has climbed. Strong economic foundations, the improvement of the infrastructure, and government efforts to entice international investment are the driving forces behind this increasing trend.

Investment Chances for Global Investors

For foreign investors seeking to diversify their portfolios and access the Middle Eastern market, the DFM offers appealing prospects. Investors have access to the region’s thriving economy through a variety of investment vehicles, including shares, exchange-traded funds (ETFs), bonds, and real estate investment trusts (REITs). These vehicles also offer the potential for sizable profits.

Profits from investing in Dubai Market

Diverse prospects for profit can be found by investing in the Dubai Financial Market (DFM).

When investing in the Dubai Financial Market, keep the following in mind:

- Economic Development: Throughout the years, Dubai has seen substantial economic expansion, which has been fuelled by elements including tourism, global trade, real estate development, and finance.

- Strategic Location: Access to emerging markets in the Middle East, North Africa, and South Asia areas is made possible by Dubai’s strategic location as a major international financial and business hub.

- Diverse Industries: The DFM represents numerous sectors, including banking, construction, telecommunications, real estate, hotel, and retail. By distributing assets across several businesses, diversification can reduce risk and create possible profit possibilities as other areas grow.

- Government Initiatives: The Dubai administration has put in place several programs to entice international investment and foster economic expansion. These include the creation of free zones, tax incentives, the growth of infrastructure, and business-friendly legislation.

- Strong Regulatory Framework: The independent regulator in charge of policing financial services operations in the Dubai International Financial Centre (DIFC), wherein the DFM is situated, is the Dubai Financial Services Authority (DFSA).

- Investor-Friendly Environment: Dubai offers a welcoming environment for investors thanks to its political stability, strong legal framework, and pro-business outlook. Participation in the DFM by foreign investors is open to anyone.

- Potential for Dividends: Many businesses with DFM listings pay shareholders dividends regularly. Particularly for long-term investors, dividends can offer a steady income stream and boost overall portfolio results.

- Market Liquidity: The DFM is well-known for its liquidity, which indicates that there is typically a lot of trade going on. Due to the comparatively simple buying and selling of stocks made possible by this liquidity, swift entry and exit techniques may be made possible.

- Considerations and Risks: The DFM investment entails some risks, just like any other investment. To effectively handle risk, it is critical to undertake in-depth research, comprehend the basics of the businesses you have an interest in, and diversify your holdings.

Conclusion

The Dubai Financial Market is a lively and thriving market that stands tall as a representation of Dubai’s economic might and ambitions for the world. The DFM is an ideal location for investors looking for possibilities in the Middle East thanks to its wide variety of listed companies, solid regulatory structure, technical improvements, and future development potential. Investors can tap into this thriving Dubai Financial Market enormous potential by taking advantage of the DFM’s distinctive features and joining Dubai’s extraordinary success story.