contact us

Crypto Training Institute in Dubai |By Zylostar|

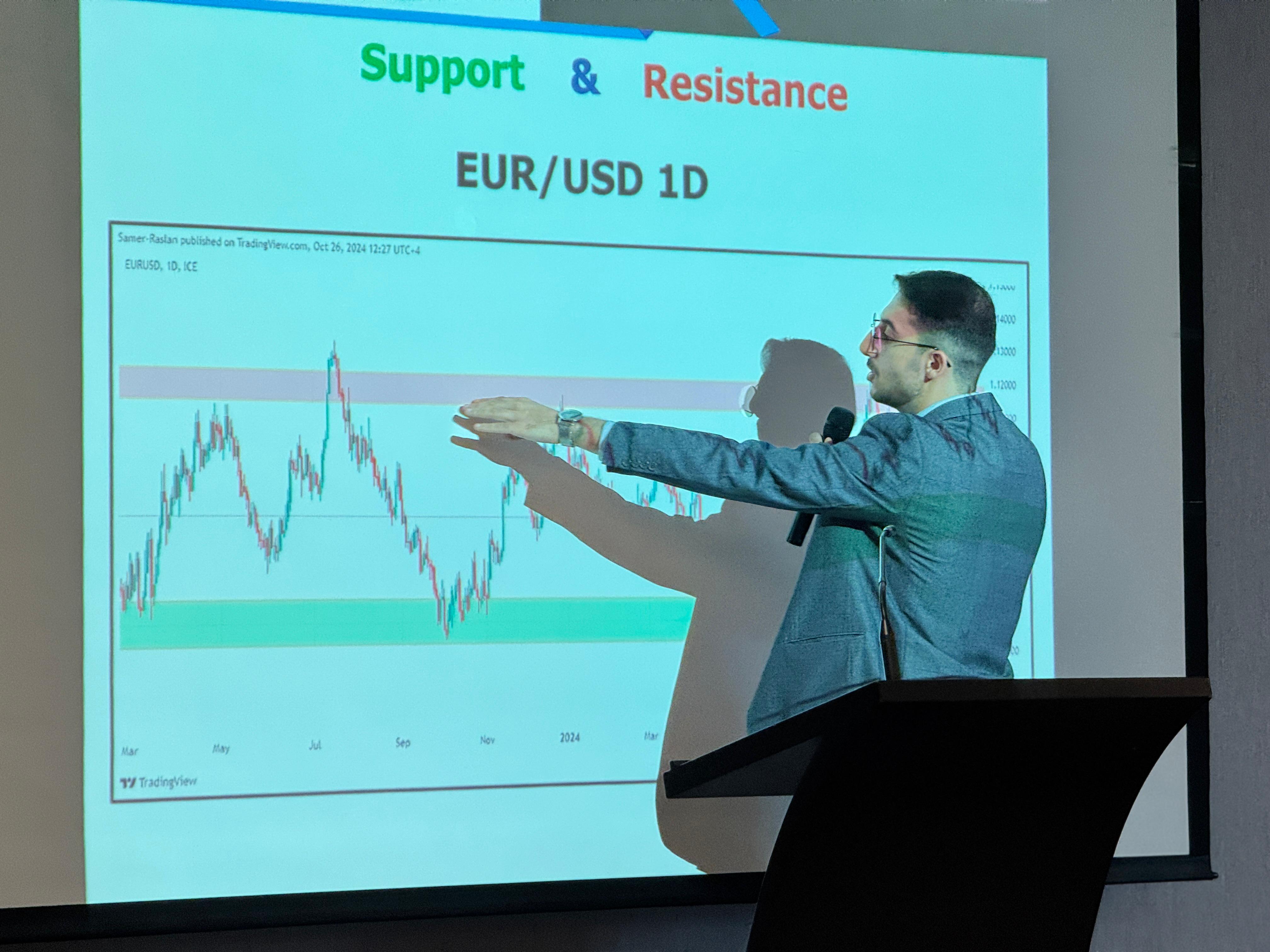

Learn cryptocurrency trading at Dubai's top academy. Our experienced trainers offer practical training and tested techniques to guide you through the unpredictable crypto market with skill and confidence.